Historical Development of Coinage and its Role in Early Economies

The Spark That Ignited Early Economies

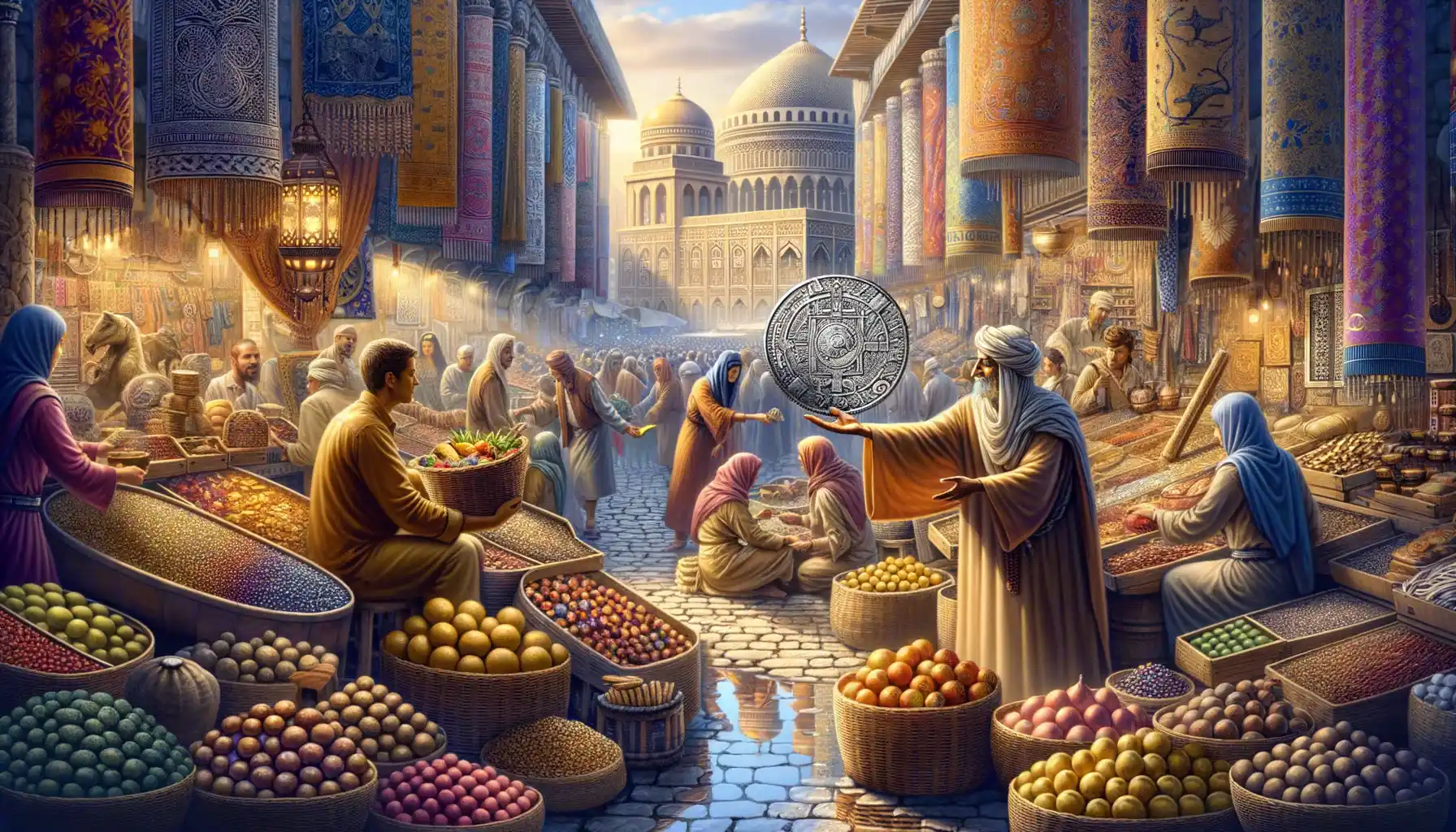

Imagine the bustling markets of ancient Lydia, where merchants once traded everything from spices to precious metals. Before coinage, bartering ruled—goats were swapped for grain, and bolts of fine linen might earn you a bag of salt. But let’s face it, carrying a herd of livestock to strike a deal wasn’t exactly practical! Enter the invention of coins: small, portable pieces of stamped metal that transformed how people exchanged goods.

The first coins made their debut around 600 BCE in Lydia (modern-day Turkey) and were crafted from **electrum**, a natural alloy of gold and silver. They weren’t just shiny tokens—they carried a promise of universal value. With their recognizable markings, coins built trust between strangers and streamlined trade. Suddenly, money wasn’t just an abstract idea; it was something you could hold, hide, or hoard.

- Coins allowed businesses to grow beyond local barter systems.

- Standardized values enabled long-distance trade and alliances.

- They even inspired cultural shifts, influencing art and symbols engraved on currency.

With these tiny treasures, economies expanded like never before, paving the way for future financial systems. Coinage was more than currency—it was a game-changer.

The Influence of Coinage on Trade and Commerce

The Spark That Ignited Global Exchange

The invention of coinage wasn’t just a turning point—it was a revolution. Imagine a bustling ancient marketplace, where farmers, artisans, and traders once haggled endlessly, swapping sacks of grain for tools or livestock. Enter coins: small, portable, and stamped with an unmistakable promise of value. Suddenly, trade didn’t rely on guesswork or barter; it thrived on certainty.

With coins jingling in their pouches, merchants could dream bigger. They weren’t confined to local exchanges anymore—they could venture farther, crossing borders and seas. These uniform, universally accepted tokens were like passports in the world of commerce. A Greek drachma might pay for Persian spices or Egyptian papyrus. And tomorrow? Silk from China or glassware from the Romans.

- It streamlined trade by erasing confusion over value.

- It reduced the risk of barter’s uneven exchanges—no more mismatched trades!

- It fostered trust across regions, creating early “global” markets.

Coinage did more than facilitate trade. It whispered stories of power and stability. A stamp on metal said, “Our empire is strong, our economy even stronger.” It was trade, but it was also prestige—a currency of confidence.

Coinage and the Evolution of Banking Systems

The Shift from Coins to Financial Institutions

Picture this: a bustling marketplace in ancient Rome, coins jingling in the pockets of merchants as they haggled over spices or silks. The clinking sound wasn’t just commerce; it was trust, stability, and promise all rolled into one metallic emblem. But then, as trade boomed and wealth grew beyond what could be carried in a pouch, society faced a dilemma. How could vast fortunes be safeguarded, tracked, and transferred without lugging sacks of coins? Enter banking.

The evolution of banking systems began as an ingenious answer to this growing complexity. Temples and later private entities started serving as custodians for coins, storing wealth securely and issuing rudimentary forms of receipts. These receipts became more than mere bits of paper; they were the ancestors of modern currency.

- Ancient Mesopotamians had grain banks long before coinage—but the invention of coins revolutionized these institutions.

- By the Renaissance, goldsmiths turned bankers issued notes that let merchants move money without risking robbery on perilous roads.

Coinage didn’t die—it adapted. It stepped aside slightly, allowing banks and financial systems to extend its power in ways unimaginable in those Roman streets.

From Hefty Gold to a Ledger Entry

Think about how coins, once physical and tangible, transformed into the invisible. This wasn’t magic—it was innovation driven by necessity. As empires expanded, the need for convenient, portable wealth only grew. Banking systems harnessed the value of coins while shrinking their weight, so to speak.

Consider Venice, a city built on canals and commerce. By the 1400s, Venetian banks offered accounts where traders could deposit their coins and transfer sums through ledgers rather than hauling metal. These records were not just convenience—they symbolized trust in human infrastructure over physical wealth.

Each ledger entry, whether in Renaissance Italy or a modern digital bank, traces its lineage to the clink of those ancient coins. But here’s the crux: while coins might no longer clink in our pockets as often, they remain the bedrock of how we measure, exchange, and imagine value.

The Societal Implications of Monetary Standardization

How Standardized Money Reshaped Human Interaction

Imagine a world where every town had its own peculiar form of payment. A farmer might accept sheep for grain, while a cobbler demanded silver bars—or worse, a specific type of pottery. Chaos, right? That’s the kind of messy barter system early societies dealt with until coinage entered the stage like a hero in shining metal. But here’s the real twist: it wasn’t just about smoother trades; it profoundly reshaped how people related to one another.

With the advent of standardized currencies, something magical happened. Boundaries blurred, and identities shifted. Suddenly, a merchant from Athens could trade seamlessly with someone in Persia using universally recognized coins. Money became a great equalizer—a shared language understood by different tongues.

- Trust: Coins built confidence. Their weight, design, and material became symbols of reliability.

- Power dynamics: Governments used currency to assert control and extend influence, stamping their authority—literally—on every transaction.

- Social mobility: Wealth became easier to accumulate and display, opening new doors for ambitious individuals.

Standardized money didn’t merely standardize trade—it standardized opportunity, paving the way for a more interconnected, yet hierarchical world.

Modern Perspectives on Coinage in Contemporary Economics

The Revival of Coins in a Digital Age

In a world dominated by cashless payments and cryptocurrency, where swiping a card or scanning a QR code reigns supreme, you’d think metal coins would be relics of the past. And yet, here they are—small, gleaming survivors in your pocket, jingling like little rebels against technology. So why haven’t they disappeared?

For one, coins remain functional anchors in many economies, particularly in developing regions where every cent or rupee counts. They’re also deeply tied to our sense of stability—physical symbols of worth that can’t vanish with a server glitch. Imagine grabbing a coffee at a street café in Paris. The barista hands you change in euros, and for a moment, it feels personal, even tactile. That connection? You can’t Venmo it.

- Durability: Coins outlive paper bills. A single coin might pass through a thousand hands before fading from circulation.

- Nostalgia: Collectors still chase rare coins like treasures, weaving history and value into their very identity.

Coins as Symbols of Sovereignty

Beyond economics, coins whisper stories of nationhood and artistry. A country’s currency often displays its heroes, landmarks, or ideals. Take the Canadian “toonie” or the intricate designs of Japanese yen—they’re miniature billboards of pride and culture.

Paradoxically, while flashy digital payment systems make life easier, they lack something coins have in abundance: character. It’s why governments continue to mint commemorative coins, celebrating everything from moon landings to royal anniversaries. These aren’t just currency; they’re tangible memories meant for keeping, not spending.